In the current financial landscape, the importance of a high-yield savings account cannot be overstated. With the prevailing interest rate environment, every percentage point can significantly impact your savings growth. One of the key players in this arena is Bank of America, a well-established banking institution offering a variety of savings account options. But how do their interest rates compare to the competition? Let’s delve into the details.

Bank of America Savings Account Interest Rates

Bank of America’s primary savings account offering is the Bank of America Advantage Savings account. Here are some key features and requirements of this account:

- Minimum deposit requirement: To open an Advantage Savings account, a certain initial deposit is required. The exact amount may vary, so it’s advisable to check with the bank for the most current information.

- Monthly maintenance fee: Like many savings accounts, there’s a monthly fee associated with this account. However, Bank of America provides several ways to waive this fee, such as maintaining a minimum daily balance or linking your account to a Bank of America Advantage Relationship Banking account.

- Standard APY: The annual percentage yield (APY) is the actual rate of return earned on a savings account, considering the effect of compounding interest. Unfortunately, the APY on the Advantage Savings account is not as competitive as one might hope.

When we compare Bank of America’s savings account rates to the national average, it’s evident that they fall short. This is a common trend among traditional banks like Bank of America, which tend to offer lower savings rates due to their extensive physical presence and higher overhead costs.

Exploring Higher-Yield Savings Options

If you’re seeking a more competitive return on your savings, high-yield online savings accounts might be worth considering. These accounts, offered by online-only banks, often boast much higher interest rates than traditional banks. Here are a few examples of top high-yield savings account rates:

- Online Bank A: 2.50% APY

- Online Bank B: 2.75% APY

- Online Bank C: 3.00% APY

To illustrate the potential difference in earnings, let’s consider a $5,000 balance. At Bank of America’s 0.01% APY, you would earn just $0.50 in a year. In contrast, with an online bank offering a 3.00% APY, you could earn $150 – a significant difference.

Another option within Bank of America is their range of Certificate of Deposit (CD) offerings. CDs often have higher interest rates than savings accounts, but they require you to lock in your money for a certain period. Bank of America’s CDs come with various minimum deposit requirements and rate tiers, but even their highest rates often can’t compete with high-yield savings accounts.

Boosting Savings Rates with Bank of America’s Preferred Rewards Program

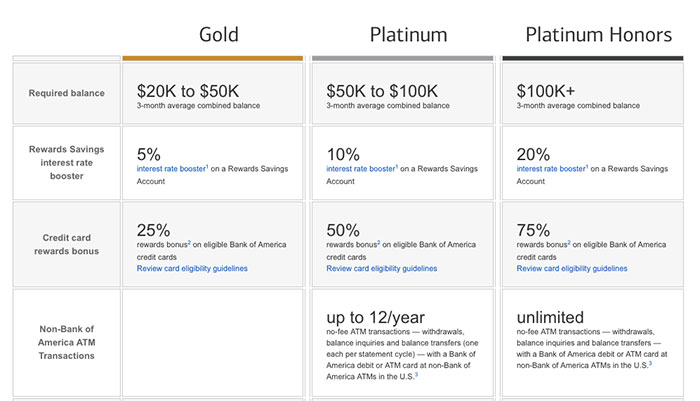

Bank of America offers a Preferred Rewards program that can potentially boost your savings rate. This program has several tiers, each with its own qualification requirements and interest rate bonuses. However, even with these bonuses, it’s worth considering whether the Preferred Rewards program can truly make Bank of America’s savings rates competitive with high-yield options.

Finding the Current Bank of America Savings Account Rates

To find the most up-to-date savings account rates, you can visit the Bank of America website. It’s important to check these rates regularly, as they can change based on various factors, including the overall economic environment.

Is Bank of America a Good Choice for a Savings Account?

When considering Bank of America for a savings account, there are several pros and cons to weigh:

| Pros | Cons |

|---|---|

| Wide range of financial products | Low interest rates compared to high-yield options |

| Potential benefits for existing customers | High minimum balance requirements to avoid fees |

While Bank of America might be a convenient choice for existing customers, those seeking the highest savings rates may want to look elsewhere.

Conclusion

In conclusion, while Bank of America is a reputable institution with a wide range of financial products, their savings account interest rates are not as competitive as those offered by high-yield online banks. It’s always important to shop around and consider all your options to ensure you’re getting the best return on your savings. Remember, every percentage point counts when it comes to growing your savings.