REITs

Welcome to the world of Real Estate Investment Trusts, or REITs as they are commonly known. If you’re a beginner looking to dip your toes into the investment pool, REITs can be a great place to start. But what exactly are REITs? Let’s dive in and find out.

Definition of REITs (Real Estate Investment Trusts)

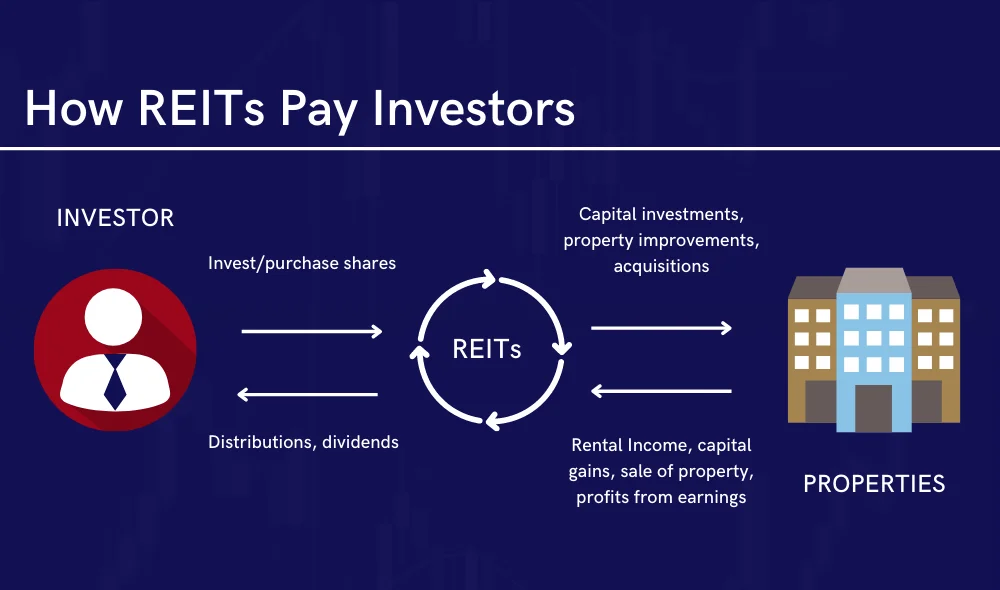

REITs are companies that own, operate, or finance income-generating real estate. They allow individuals to invest in portfolios of real estate assets the same way they would invest in other industries – through the purchase of individual company stock or through a mutual fund or exchange traded fund (ETF).

Explanation of how REITs work and their purpose

The primary purpose of REITs is to provide a way for individual investors to earn a share of the income produced through commercial real estate ownership. This is something that was previously only available to wealthy individuals. REITs work by pooling the capital of numerous investors. This makes it possible to purchase a diversified portfolio of properties.

Benefits of investing in REITs

Investing in REITs comes with several benefits. They provide a way for individual investors to access real estate assets, offer a long-term track record of dividend-based income, competitive market performance, transparency, liquidity, and diversification.

Understanding the Different Types of REITs

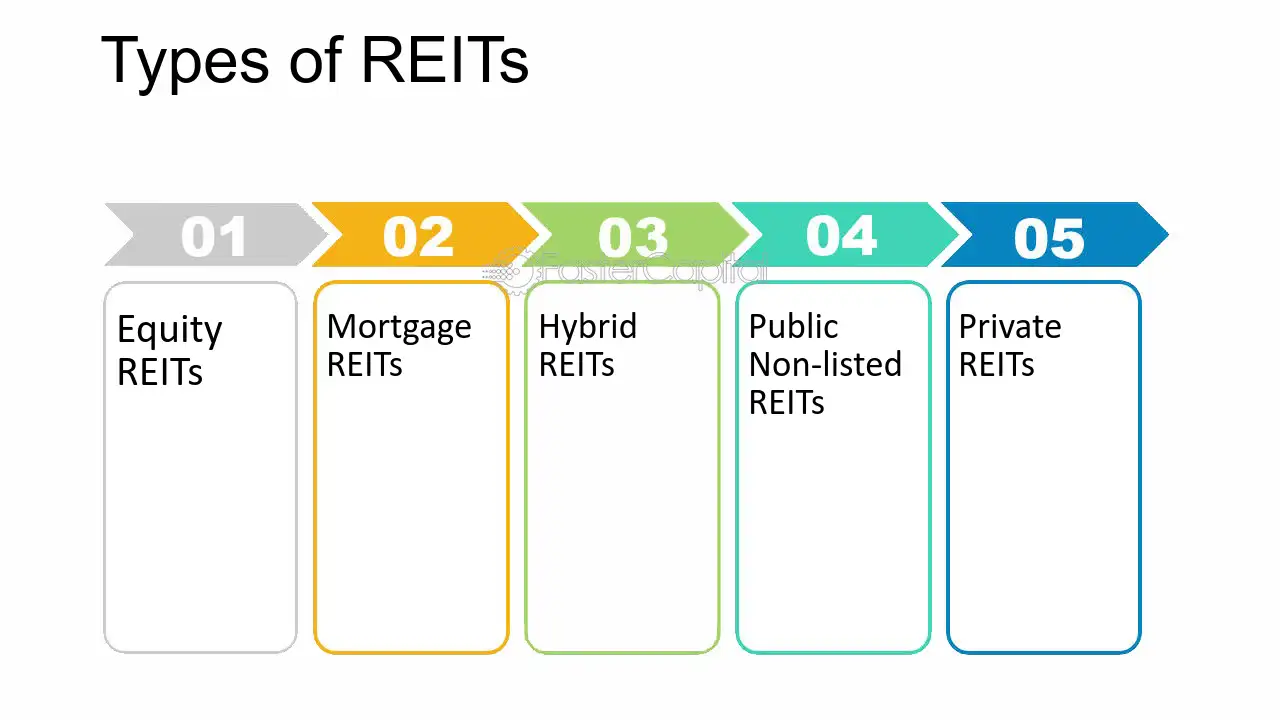

There are several types of REITs, each with its own set of characteristics and benefits. Let’s take a closer look at each of them.

Equity REITs

Equity REITs own and manage income-producing real estate. They are responsible for the equity or value of their real estate assets. They generate income by leasing space and collecting rent on its owned properties.

Mortgage REITs

Mortgage REITs, on the other hand, don’t own real estate directly. Instead, they finance real estate and earn income from the interest on their investments.

Hybrid REITs

As the name suggests, Hybrid REITs combine the investment strategies of Equity REITs and Mortgage REITs by investing in both properties and mortgages.

Characteristics and differences between the REIT types

While all REITs aim to provide income to investors, the way they generate this income varies. Equity REITs generate income through rent on their properties, Mortgage REITs earn interest on their mortgage loans, and Hybrid REITs do a bit of both.

Reasons to Invest in REITs

Investing in REITs can be a smart move for several reasons. Here are a few to consider:

- Diversification: REITs can help diversify your investment portfolio. They have a low correlation with other stocks and bonds, which can provide balance in varying market conditions.

- Steady income: REITs are required by law to distribute at least 90% of their taxable income to shareholders annually. This can provide a steady income stream for investors.

- Potential for capital appreciation: Over the long term, REITs have the potential for capital appreciation in addition to income.

- Tax advantages: REIT dividends are often taxed at a lower rate than ordinary income.

Researching and Selecting REITs

Choosing the right REITs to invest in requires careful research and analysis. Here are some key factors to consider:

Analyzing REIT performance metrics

There are several key metrics to consider when evaluating a REIT’s performance:

- Funds from Operations (FFO): This is considered the most important metric in REIT analysis. It measures a REIT’s cash flow from its operations.

- Dividend yield: This is the annual dividend divided by the stock price. It’s a good indicator of the income you can expect from a REIT.

- Debt-to-equity ratio: This measures a company’s financial leverage and can give you an idea of the risk involved with a particular REIT.

- Occupancy rates: High occupancy rates can indicate a successful REIT.

Evaluating REIT sectors and property types

REITs can be categorized based on the type of properties they own. These can include:

- Residential: These REITs own and operate multi-family rental apartment buildings and manufactured housing.

- Commercial: These REITs own and operate office buildings, warehouses, and retail properties.

- Industrial: These REITs own and operate industrial facilities and warehouses.

- Retail: These REITs own and operate shopping malls, strip malls, and other retail spaces.

- Specialty (e.g., healthcare, data centers): These REITs focus on specific niche markets such as healthcare facilities, data centers, and infrastructure.

Considering REIT management and track record

The management team’s experience and track record can significantly impact a REIT’s performance. Look for a team with a proven track record of managing and growing profitable real estate investments.

How to Invest in REITs

There are several ways to invest in REITs:

- Buying individual REIT stocks: You can buy shares of individual REITs just like you would any other company on a major stock exchange.

- Investing in REIT mutual funds or ETFs: These funds invest in a diversified portfolio of REIT stocks. They offer a way to invest in a broad range of REITs with a single purchase.

- Utilizing a REIT investment platform or robo-advisor: These platforms can help you build a diversified portfolio of REITs based on your investment goals and risk tolerance.

Strategies for REIT Investing

There are several strategies you can use when investing in REITs:

- Long-term buy-and-hold approach: This strategy involves buying REIT shares and holding them for a long period. It’s based on the belief that real estate values will increase over time.

- Dividend reinvestment: This strategy involves using the dividends you receive from your REIT investments to buy more shares.

- Sector rotation: This strategy involves moving your investments from one sector to another based on economic conditions.

- Opportunistic investing: This strategy involves investing in REITs based on short-term price movements.

Risks and Considerations in REIT Investing

Like any investment, REITs come with their own set of risks:

- Market volatility: The value of REIT shares can fluctuate based on the overall health of the economy and the real estate market.

- Interest rate sensitivity: REITs are sensitive to interest rate changes. When interest rates rise, the cost of borrowing increases, which can impact a REIT’s profitability.

- Leverage and debt levels: REITs often use debt to finance their operations. High levels of debt can increase risk.