In the realm of financial planning, long-term investment holds a pivotal role. It’s a strategy that involves holding an investment for a period typically exceeding five years, with the expectation of substantial returns. The focus of this discourse is to unravel the concept of a Long-Term Investment Plan and explore its various forms, including stocks, bonds, real estate, and alternative investments.

Understanding Long-Term Investments

Long-term investments are akin to a marathon, not a sprint. They’re not about instant gratification but about potential growth over an extended period, typically five years or more. The primary objective is capital appreciation, with income generation being a secondary benefit.

The advantages of long-term investments are numerous. They offer the potential for compounding growth, where your earnings generate their own earnings. They also provide the ability to weather market fluctuations, as short-term market dips may be offset by long-term trends. Most importantly, they can help you achieve your long-term financial goals, be it a comfortable retirement, funding your children’s education, or buying your dream home.

Types of Long-Term Investments

Stocks and Equity Investments

Stocks, representing ownership in a company, form the backbone of most long-term investment portfolios. They offer the potential for capital appreciation, dividend income, and diversification.

However, investing in stocks is not without risks. These include market volatility, company-specific risks, and liquidity concerns. It’s essential to thoroughly research any company before investing and diversify your portfolio to spread the risk.

Bonds and Fixed-Income Investments

Bonds are loans that investors make to entities (like governments or corporations) in exchange for regular interest payments and the return of the principal amount at maturity. They offer a steady income stream and are generally considered lower risk than stocks.

However, bonds are not risk-free. They are subject to interest rate risk (bond prices fall when interest rates rise), credit risk (the issuer may default on the payment), and inflation risk (the fixed income may lose purchasing power over time).

Real Estate Investments

Real estate investments involve purchasing property for rental income or capital appreciation. They offer potential for capital appreciation, rental income, and diversification.

However, real estate investments come with their own set of risks. These include illiquidity (it can be challenging to sell a property quickly), property management challenges, and the impact of market and economic conditions on property values.

Alternative Investments

Alternative investments are a broad category that includes commodities (like gold, silver, and oil), cryptocurrencies, private equity, venture capital, and hedge funds. They can provide diversification and the potential for higher returns.

However, alternative investments can be complex and lack transparency. They also often have liquidity concerns and can be subject to regulatory and legal risks.

Factors to Consider When Choosing a Long-Term Investment

Investment Objectives

Your investment objectives should guide your investment choices. Consider your short-term and long-term goals, your risk tolerance, and your time horizon.

Asset Allocation

Diversification across different asset classes can help balance risk and return. Regular rebalancing can help maintain your desired asset allocation.

Investment Costs and Fees

Be aware of expense ratios, transaction costs, and tax implications of your investments.

Liquidity and Accessibility

Consider your ability to access funds when needed and be aware of withdrawal policies and penalties.

Risk Management

Strategies to mitigate investment risks include hedging techniques, diversification, and portfolio rebalancing.

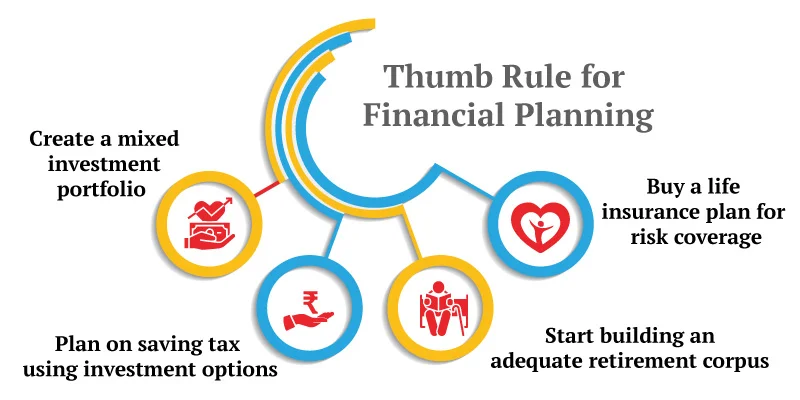

Developing a Comprehensive Long-Term Investment Plan

- Assess your current financial situation: Evaluate your income, expenses, and savings.

- Determine your risk tolerance and investment objectives.

- Set long-term financial goals: This could be retirement planning, wealth accumulation, or education funding.

- Develop an asset allocation strategy: Diversify across different asset classes and adjust allocation based on risk tolerance and time horizon.

- Select appropriate investment vehicles: This could be stocks, bonds, real estate, or alternative investments.

- Consider investment costs and tax implications.

- Regularly review and adjust your plan: Monitor portfolio performance, rebalance as needed, and adapt to changes in your financial situation or market conditions.